Harmony Bitspire

Harmony Bitspire: Analisi AI per Scelte di Mercato Strategiche

Harmony Bitspire utilizza modelli analitici strutturati per interpretare i cambiamenti in tempo reale nei mercati digitali. Sistemi adattivi trasformano le variazioni rapide in segnali stabili, riducendo i ritardi e permettendo reazioni basate su dati aggiornati.

Attraverso l’elaborazione avanzata dei flussi di dati continui, Harmony Bitspire individua segnali iniziali e aree di interesse prima che siano visibili su larga scala. Queste letture precoci favoriscono scelte coerenti e puntuali.

Chi analizza strategie ispirate a profili esperti può semplificare l’interpretazione dei segnali tramite Harmony Bitspire. Anche se la piattaforma non esegue operazioni, fornisce indicazioni basate sull’AI in tempo reale per facilitare valutazioni e decisioni ben fondate.

I cambiamenti rapidi dei mercati globali vengono interpretati da Harmony Bitspire grazie a sistemi di apprendimento adattivo in grado di rispondere istantaneamente ai dati in arrivo. Una struttura di sicurezza a più livelli protegge ogni interazione, mentre un motore analitico in evoluzione continua a supportare decisioni ben contestualizzate.

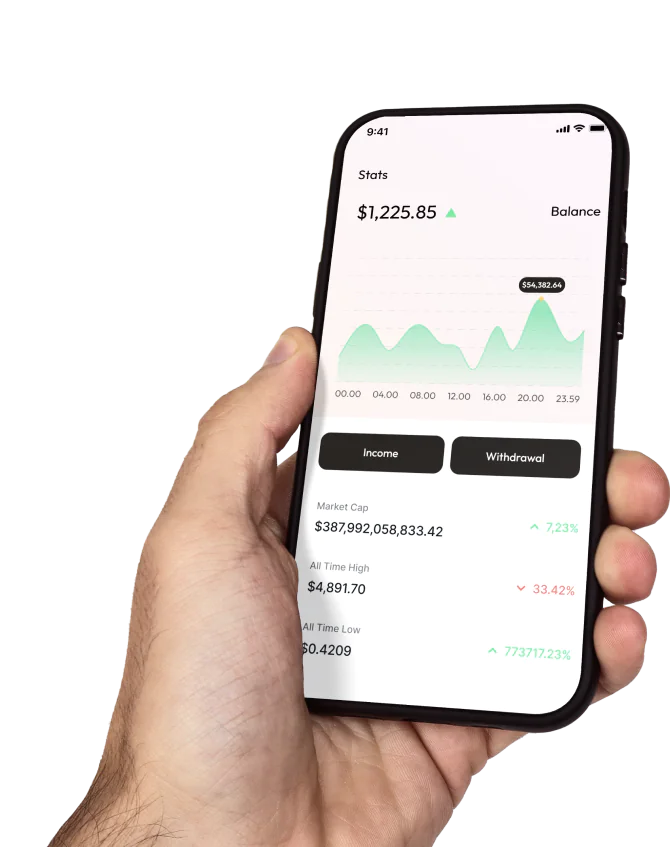

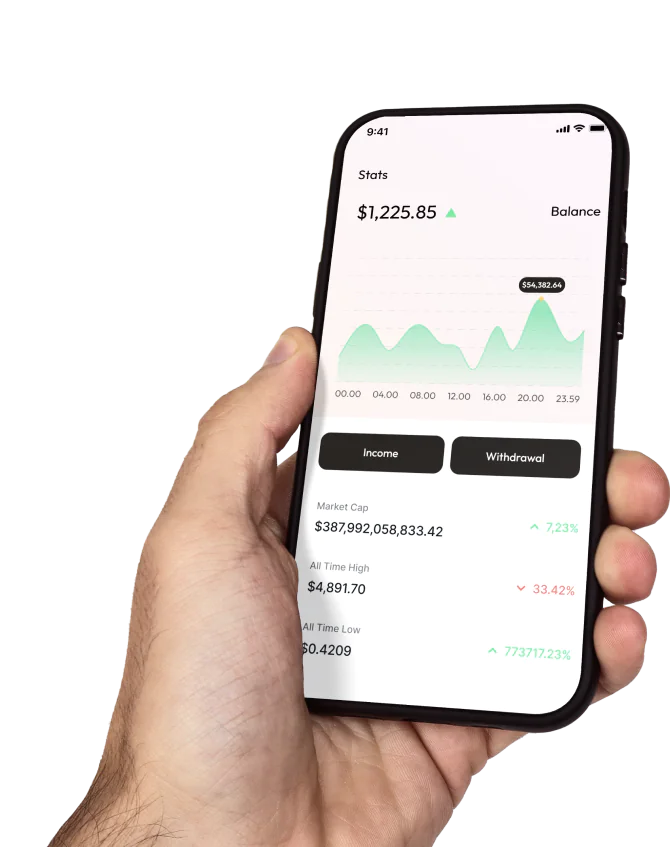

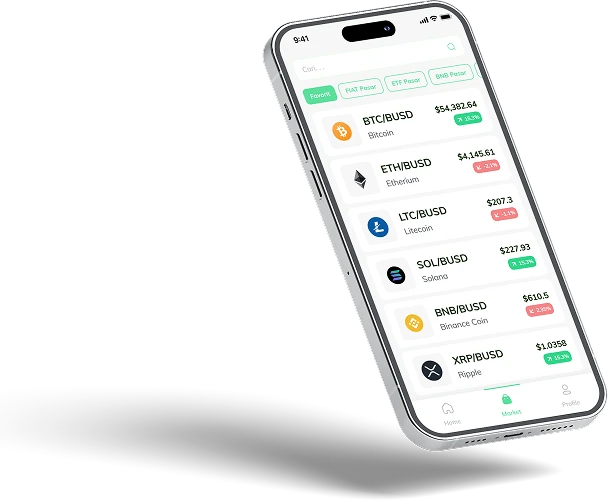

Harmony Bitspire osserva i movimenti degli asset digitali con precisione mirata, aggiornando i dati in tempo reale per garantire coerenza. Il motore AI analizza schemi ricorrenti e segnali strutturali, fornendo indicazioni chiare, tempi di risposta ridotti e una visione affidabile dei rischi potenziali.

Harmony Bitspire si adatta ai rallentamenti di flusso di mercato analizzando in tempo reale segnali appena visibili. Confrontando i dati attuali con cicli precedenti, Harmony Bitspire intercetta le prime variazioni e le traduce in indicazioni operative sintetiche.

Harmony Bitspire offre accesso a tecniche sperimentate da professionisti del settore. L’uso resta manuale: l’intelligenza artificiale osserva i modelli e fornisce una struttura che consente scelte autonome e consapevoli, mantenendo il controllo completo nelle mani dell’utente.

Harmony Bitspire si concentra su analisi indipendenti, senza esecuzione di ordini e senza legami con piattaforme esterne. Le informazioni restano integre e protette, consentendo valutazioni chiare e libere da distorsioni. Ogni informazione è conservata su archivi cifrati e protetta da accessi controllati. L’ingresso richiede verifiche, mentre controlli regolari garantiscono trasparenza. Nessun collegamento con gli exchange mantiene la neutralità operativa. I mercati delle criptovalute sono altamente volatili e perdite possono verificarsi.

Harmony Bitspire funziona come uno spazio analitico dedicato a sostenere un giudizio equilibrato senza sostituire le decisioni autonome. L ambiente rimane flessibile e consente agli utenti di mantenere il pieno controllo delle proprie scelte contando su strumenti che osservano le condizioni di mercato con precisione costante. Ogni livello di analisi segue attentamente i movimenti rilevando anche variazioni sottili che potrebbero passare inosservate durante fasi di elevata attività.

Attraverso la sincronizzazione dei flussi di dati continui Harmony Bitspire segue l andamento delle criptovalute mentre si sviluppa in tempo reale rendendo ogni cambiamento immediatamente visibile. Le informazioni emergono quando l attività è ancora in corso anziché basarsi su riepiloghi tardivi. Questa visione diretta permette valutazioni puntuali mentre il movimento prende forma mantenendo l analisi sempre connessa alle condizioni live del mercato.

Harmony Bitspire sviluppa una comprensione multilivello che riduce scelte impulsive e incoraggia una direzione strategica a lungo termine. L’analisi si basa su criteri strutturati evitando reazioni instabili o spinte emotive. Il sistema analizza grandi flussi di dati per separare segnali rilevanti dai rumori inutili garantendo una lettura stabile del mercato.

Elaborando movimenti dinamici dei prezzi Harmony Bitspire si adatta al ritmo del mercato per perfezionare la valutazione degli asset in ogni fase. La combinazione tra dati in tempo reale e modelli validati consente una lettura più profonda oltre i segnali superficiali.

Harmony Bitspire integra l’andamento storico con il rilevamento dei modelli per evitare letture frammentate sulla volatilità. L’analisi di cicli ripetuti e strutture storiche consente al sistema di individuare schemi ricorrenti nelle tendenze degli asset digitali fornendo una base solida all’interpretazione attuale.

Con visibilità continua Harmony Bitspire mantiene l’osservazione costante sui cambiamenti del mercato. L’intelligenza artificiale elabora flussi di dati in tempo reale analizzando migliaia di variabili senza mai perdere segnali significativi durante l evoluzione.

L’interfaccia di Harmony Bitspire include un sistema di supporto strutturato per semplificare ogni operazione. Nessuno resta affidato a tentativi casuali poiché ogni fase viene accompagnata da istruzioni chiare. Anche le funzioni complesse diventano gestibili garantendo un utilizzo fluido dell’intera piattaforma.

Harmony Bitspire gestisce enormi volumi di dati con velocità, rilevando variazioni in tempo reale per perfezionare entrate, tempistiche e aggiustamenti tattici. Che si tratti di utenti esperti o principianti le informazioni restano pertinenti e aggiornate senza richiedere interventi continui.

Rilevando segnali attivi e collegandoli a strutture strategiche avanzate Harmony Bitspire propone osservazioni utili lasciando il pieno controllo a chi utilizza il sistema. Le strategie non vengono eseguite in automatico e ogni aggiornamento arriva con il giusto anticipo per una valutazione consapevole.

Attraverso verifiche multilivello e gestione sicura dei dati Harmony Bitspire fornisce un ambiente stabile adatto a ogni tipo di partecipante. La piattaforma si basa su fiducia trasparenza e rigore operativo. Vista la volatilità dei mercati crypto esiste la possibilità di subire perdite finanziarie.

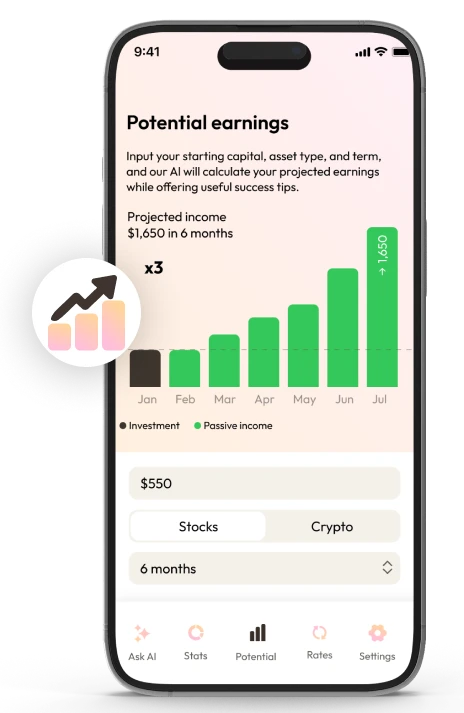

Le opportunità contano poco senza coerenza. Harmony Bitspire unisce interventi rapidi a piani di lungo periodo basandosi su risultati precedenti analisi del comportamento degli asset e segnali macro che suggeriscono la direzione.

I sistemi AI integrati in Harmony Bitspire monitorano numerose variabili e generano segnali in anticipo quando il contesto inizia a cambiare. Questa prontezza facilita il confronto delle alternative la scelta di strategie e la sicurezza nelle decisioni durante condizioni dinamiche.

Il breve termine richiede reazioni veloci il lungo termine richiede visione estesa. Uno si basa su precisione quotidiana l altro su direzioni ampie. Harmony Bitspire valuta entrambi i livelli offrendo suggerimenti adeguati allo stile operativo di ciascun utente.

La liquidità incide sulla qualità delle esecuzioni la stabilità dei prezzi e la velocità dei movimenti. Quando è abbondante le operazioni sono fluide quando è scarsa emergono picchi e sbalzi. Harmony Bitspire segue il flusso della liquidità per individuare pressioni di acquisto o vendita e valutare le scelte in modo mirato.

Una pianificazione corretta definisce limiti di perdita e obiettivi alternativi per mantenere coerenza. Capire quando agire o attendere richiede equilibrio. Gli strumenti AI di Harmony Bitspire segnalano aree del mercato da osservare migliorando il bilanciamento tra prudenza e progressione calcolata.

Grazie a modelli evoluti e revisione in tempo reale Harmony Bitspire intercetta dinamiche che si celano sotto la volatilità apparente. I sistemi isolano segnali rilevanti escludendo i rumori e collegano prezzo volume e sentiment per offrire una visione coerente nei contesti che cambiano.

Indicatori tecnici come MACD, Fibonacci Retracement e Stochastic Oscillator sono inclusi all'interno di Harmony Bitspire, ognuno offrendo un’angolazione diversa sull’andamento dei prezzi.

Fibonacci evidenzia i punti di ritracciamento, MACD segnala variazioni di tendenza e slancio, mentre lo Stocastico rileva zone di ipercomprato o ipervenduto. L’intelligenza artificiale di Harmony Bitspire filtra il rumore eccessivo rendendo più chiari e pertinenti i segnali da seguire per adattare la strategia.

Una volta eliminato il disturbo, gli strumenti diventano più efficaci. Con Harmony Bitspire si ottiene una visione più nitida delle condizioni reali, migliorando l’efficacia delle scelte operative.

Poiché il prezzo riflette l'opinione collettiva, comprendere il sentiment è parte integrante dell’analisi. Harmony Bitspire raccoglie informazioni da notizie, discussioni tra trader e commenti di mercato e le sintetizza in punti chiave.

Il motore del sentiment esamina grandi set di dati cercando schemi ricorrenti che spesso precedono cambiamenti nell’umore generale. Posizioni più ottimistiche possono anticipare salite, mentre toni più deboli possono segnalare pressioni al ribasso.

Queste intuizioni completano l'analisi tecnica. Le scansioni continue di Harmony Bitspire aiutano a regolare le decisioni sulla base del contesto emotivo che si sviluppa nei mercati.

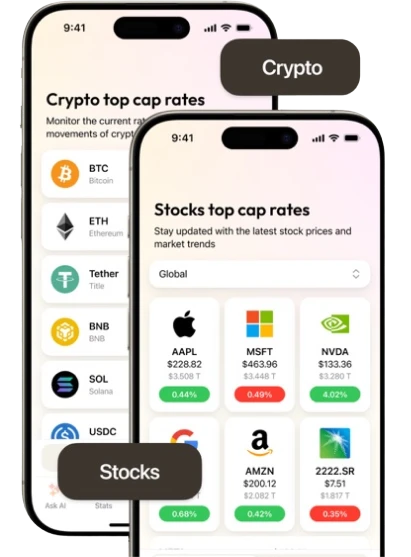

Notizie come dati sull’occupazione, tassi d’inflazione o decisioni delle banche centrali possono innescare reazioni improvvise nei prezzi degli asset digitali. Con l’analisi macro alimentata dall’AI, Harmony Bitspire segue l’impatto di questi eventi osservando come certe fasi riportino attenzione sulle soluzioni decentralizzate.

Anche le modifiche normative influenzano il quadro. Confrontando situazioni passate con quelle attuali, Harmony Bitspire propone scenari plausibili aiutando a valutare le opzioni in anticipo.

Harmony Bitspire trasforma lo scenario economico in aggiornamenti comprensibili e orientati all’azione. Taglia fuori il superfluo e ordina le informazioni per mettere in evidenza solo ciò che ha impatto reale, evitando sovraccarichi di numeri o dati inutili.

I risultati sono spesso legati alla precisione nei tempi durante le fasi di mercato. Harmony Bitspire confronta i modelli storici con i dati attuali per identificare possibili cambi di direzione o variazioni di volatilità. Il comportamento degli asset viene analizzato insieme agli indicatori tecnici per ridurre l’incertezza nella pianificazione e nei momenti di intervento.

Proseguendo su questa base Harmony Bitspire approfondisce le strutture ricorrenti i cicli di volatilità e i comportamenti di breakout per rafforzare la capacità di osservazione. Questo livello aggiuntivo di analisi migliora la sensibilità al fattore tempo mostrando come certi schemi si ripresentino spesso in contesti diversi offrendo maggiore consapevolezza per affrontare gli sviluppi futuri.

La diversificazione riduce l'impatto degli shock sostenendo la stabilità nel tempo. Harmony Bitspire esamina i modelli storici di allocazione e sfrutta l’intelligenza artificiale per simulare la reazione delle combinazioni in condizioni di stress. Aiuta a costruire portafogli resistenti, rileva connessioni nascoste tra asset e consente aggiustamenti mirati quando il mercato cambia improvvisamente.

Filtrando i rumori di fondo e distinguendo le variazioni fuorvianti Harmony Bitspire mette in evidenza le prime formazioni che spesso anticipano movimenti importanti. Piccoli schemi grafici o picchi insoliti di attività possono emergere in anticipo dando un vantaggio nell’identificare possibili tendenze prima che diventino evidenti.

Il momentum inizia spesso in silenzio. Un leggero aumento dei volumi, ripetuti contatti sui prezzi o una pressione direzionale costante possono segnalare un accumulo nascosto. Harmony Bitspire osserva attentamente queste fasi iniziali distinguendole dai semplici movimenti casuali per cogliere segnali che altrimenti passerebbero inosservati.

Harmony Bitspire utilizza l’AI per tracciare i movimenti di prezzo irregolari distinguendo tra impennate improvvise inversioni rapide o variazioni temporanee. Questi cambiamenti vengono letti come segnali potenziali piuttosto che disturbi casuali offrendo una visione ordinata nel caos apparente.

Alla base di Harmony Bitspire c’è l’unione tra strumenti computazionali evoluti e logica analitica strutturata per ridurre il peso dei dati continui. Gli algoritmi trasformano i comportamenti di mercato in indicazioni operative semplificate.

Gli utenti mantengono il pieno controllo grazie a strumenti adattivi che rispondono ai cambiamenti mantenendo coerenza analitica. Anche nei momenti di alta volatilità Harmony Bitspire conserva l’integrità metodologica offrendo una guida stabile senza farsi influenzare da rumori generati dal panico.

Harmony Bitspire sfrutta il machine learning per analizzare grandi quantità di dati con precisione avanzata. Anche i cambiamenti più impercettibili vengono rilevati e tradotti in segnali comprensibili. Invece di fornire flussi infiniti di numeri il sistema filtra solo ciò che conta e lo presenta in modo immediato e leggibile.

La struttura di Harmony Bitspire è pensata per risultare intuitiva a ogni livello di esperienza. I principianti trovano un’interfaccia semplice da usare mentre i più esperti accedono ad approfondimenti tecnici. Sia chi è agli inizi sia chi conosce già le dinamiche di mercato può navigare la piattaforma senza difficoltà.

Harmony Bitspire si concentra esclusivamente sull’analisi dei mercati senza effettuare operazioni o connettersi a scambi. Non esegue ordini ma offre interpretazioni strutturate basate su intelligenza artificiale. L’obiettivo è aiutare a comprendere il mercato e supportare le decisioni in modo consapevole senza ricorrere

| 🤖 Costo Di Registrazione | L accesso alla piattaforma è disponibile senza alcun costo di iscrizione |

| 💰 Struttura Dei Costi | Non sono previsti addebiti nascosti o spese non dichiarate |

| 📋 Creazione Dell Account | Procedura di registrazione semplice e rapida pensata per un accesso immediato |

| 📊 Ambiti Formativi | Contenuti educativi dedicati agli asset digitali ai mercati valutari e ai principi di investimento |

| 🌎 Disponibilità Geografica | Il servizio è accessibile nella maggior parte dei paesi ad eccezione degli Stati Uniti |